Bank guarantee

Service

DANEROCK Investment Group offers:

• Investment financing from €50 million and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Loan guarantees

Sector

The use of bank guarantees for the implementation of large business projects and support of export-import operations is gaining popularity in the business community.

✓ Project finance and investment consulting from DANEROCK Investment Group:

• From €50 million and more.

• Investments up to 90% of the project cost.

• Loan term from 10 to 20 years.

The development of the world economy, along with the globalization of the financial sector, increases the role of international transactions and contracts in almost all sectors, including real estate, energy, agriculture, mining, mechanical engineering and others.

The use of bank guarantees (BG) has become the key to the successful implementation of large investment or business projects in a high-risk environment.

The benefits of bank guarantee services include the following:

• Increasing the financial liquidity of your company.

• More trust in your business from the authorities and partners.

• The recognizable brand and the strong position of our partners in the global financial market give our clients an advantage in negotiating with contractors and equipment suppliers.

• A wide choice among a variety of financial solutions for any area and project.

• Flexible conditions, maximally adapted to your business needs.

• Expert support of the ESFC team from A to Z.

To find out more about our large project financing proposals, contact ESFC Investment Group and schedule a free consultation at any convenient time.

We are always ready to find the best solution for your business.

Bank guarantees: essence and application

Bank guarantee means the bank’s obligation to pay the beneficiary of the guarantee the amount specified in the guarantee, in the event that the principal fails to fulfill its obligations or the so-called guarantee event occurs.

A guarantee event refers to the receipt by the guarantor of a written request from the beneficiary, which contains a justified requirement to perform the action provided for by the agreement, based on evidence of the principal’s failure to fulfill the obligation under the main contract.

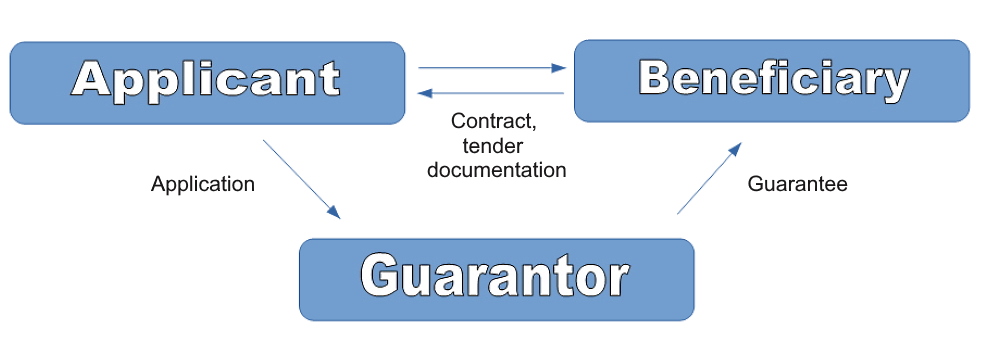

Within the framework of the guarantee relationship, the following participants can be distinguished:

• Principal (debtor) who enters into the main contract with the creditor (for example, the construction contract) and the contract with the guarantor bank.

• Beneficiary (creditor) who enters into the main contract with the debtor (for example, a service contract) and maintains a guarantee relationship with the guarantor.

• A bank or an insurance company (guarantor), which enters into appropriate agreements with the debtor and the creditor of the project.

The main contract refers to the contractual relationship between the beneficiary and the principal, which is based on the contract, legal acts or tender documents regarding the obligations of the principal, the fulfillment of which is ensured by the bank guarantee.

BG provides businesses with an effective financial instrument that will increase the safety of projects and minimize the risk associated with the bankruptcy of a counterparty.

The use of this tool increases financial liquidity and strengthens the company’s position in negotiations with suppliers and contractors on large projects.

The bank guarantee primarily protects the beneficiary, while the beneficiaries can be different parties to the contract, depending on the specific business need. In international practice, BG represents a broad concept that may apply not only to banks. It also demonstrates some of the features inherent in other mechanisms of enforcing creditors’ claims.

A brief history of the issue

The emergence of a guarantee as a way to secure the fulfillment of obligations can be explained by the fact that some loans issued by banks, by their nature, could not be secured by assets or goods.

In order to fully ensure the return of the debt, a guarantee was introduced, which subsequently evolved and was adapted to different types of transactions and projects.

The process of forming a bank guarantee took place in parallel in many countries, and in different parts of the world this process was independent and in many respects unique.

Even now, we can see significant differences in the business practices of some countries.

The legal implications of providing BG can vary greatly.

For the first time, a bank guarantee appeared in American business practice in the mid-1960s, where it took the form of a so-called standby letter of credit. Later, in the early 1970s, bankers around the world promoted the wider use of BG due to the expansion of international contracts and payments.

The growing importance of bank guarantees for large projects is associated with the implementation by Western companies of investment projects in the Middle East in such industries as oil and gas production, construction of roads and airports, development of communication networks and others.

The implementation of these projects required reliable and liquid collateral.

The International Chamber of Commerce (ICC) and the United Nations Organization took on the task of achieving international consistency in the legal regulation of the bank guarantee, and they continue this work to this day.

ICC has developed two sets of unified rules.

The first was published in 1978 and is called the Uniform Rules for Contractual Guarantees (URCG).

The second set was adopted in 1992 and is called the Uniform Rules for Demand Guarantee (URDG).

The UN began work on the international harmonization of bank guarantee rules in 1990. The United Nations Commission on International Trade Law (UNCITRAL) started the development of a full-fledged international Convention, which was to receive the status of law in the states that joined it.

The first unsuccessful draft of the document was published in 1970. Subsequent work was resumed only in 1988. Then it was planned to develop a model that countries could use in the development of national legislation in the field of financial guarantees (UNCITRAL Uniform Law on International Guaranty Letters).

Subsequently, the project received the high status of an international convention of direct action “UN Convention on Independent Guarantees and Standby Letters of Credit”.

This document was signed on December 11, 1995 in New York and entered into force on January 1, 2000.

Since the processes of forming a bank guarantee as a part of civil law took place independently in different countries, guarantee documents are called differently in business practice. In Europe, the term “guarantee” is mainly used, but the terminology differs from country to country.

It should be noted that US banks were generally not entitled to issue guarantees.

Therefore, this institution was named “standby letter of credit” or “standby credit”. In the financial literature, there is a clear similarity between a bank guarantee and a standby letter of credit, but the differences between them lie in the field of practice and business terminology (BG as a mechanism of protection against improper fulfillment of obligations under the main contract).

In the United States, standby letters of credit are used not only in the context of a bank guarantee, but more broadly.

Despite the widespread use of this financial tool at the global level, the bank guarantee does not have special regulation in the national legislation of most countries (with the exception of the United States and some others).

Classification of bank guarantees

Currently, there are several classifications of guarantees, which are based on different criteria.

These classifications are widely used in various fields. Below we will look at a few examples.

The most important types of bank guarantees in the context of large projects are considered direct and indirect guarantees, which fundamentally differ in the scheme of relations between participants.

A direct guarantee implies that the principal applies to the servicing bank, which acts as a guarantor and provides a guarantee in favor of a local or foreign beneficiary.

The diagram of the direct BG is shown in the figure below.

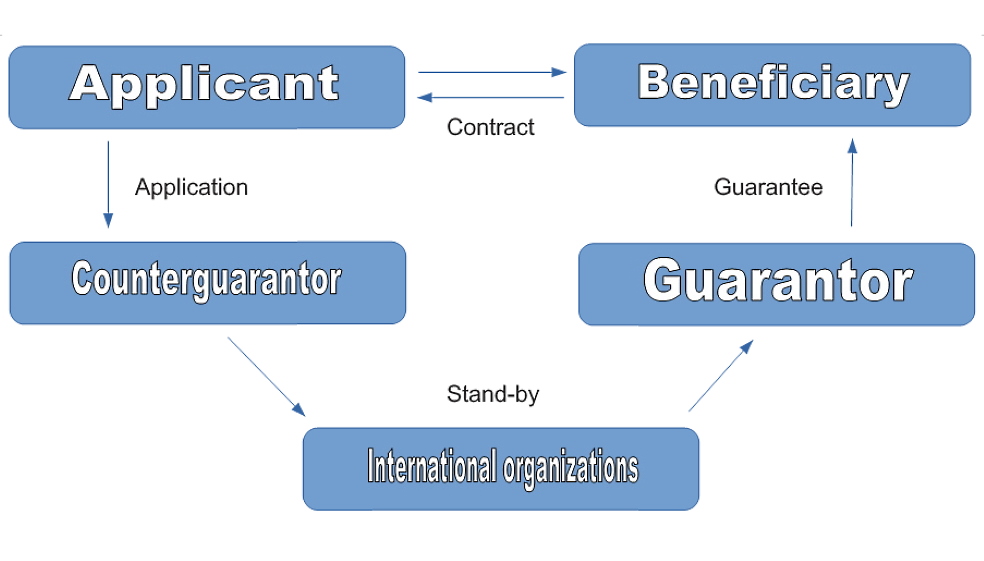

In some cases, the requirements of the host country’s financial law or the needs of a particular client dictate the need for a different type of protection. This is a so-called indirect guarantee, which includes a new participant, a counter guarantor.

An indirect bank guarantee assumes that the applicant company first contacts the servicing bank (counter guarantor), which gives certain instructions to another financial institution (the guarantor). The latter provides an official guarantee to a local or foreign beneficiary on pre-agreed terms.

The indirect guarantee mechanism can be mediated by reputable international financial institutions such as the European Bank for Reconstruction and Development or the IFC. This is especially true in the case of large strategic transactions.

A diagram of the organization of an indirect bank guarantee is shown in the figure below.

Taking into account the formal requirements and, therefore, the ease of receipt of funds by the beneficiary, financial experts offer another relevant classification of BG:

• Conditional bank guarantee. In this case, it is rather difficult for the beneficiary to receive the bank’s funds. It is necessary to fulfill the conditions set out in the agreement and provide the bank with a set of documents to verify the validity of the claims.

• Unconditional bank guarantee. In this case, the beneficiary is not obliged to perform any additional actions or provide additional documents for verification by the bank. Payment is made at the request of the recipient and does not imply additional formalities.

In the investment process, different types of insurance and bank guarantees can be used. Below are examples of the use of bank guarantees in large construction projects.

Depending on the object of protection, the following can be distinguished:

• Guarantee of proper elimination of defects and malfunctions (sometimes combined into one instrument with a guarantee of good performance of the contract). This guarantee is issued at the request of the contractor in favor of the customer in order to ensure that the requirements arising from the quality guarantee provided by the contractor are met.

• Refund guarantee, which provides a refund of money paid by the client to the contractor for construction work. It is issued at the request of the contractor in favor of the customer to ensure a refund in the event of non-fulfillment of contractual obligations. Also used in public procurement procedures.

• Guarantee of payment for construction work is issued at the request of the customer in favor of the contractor to ensure timely and full payment for his services.

Widely used types of BG also include tender guarantees, guarantees of debt repayment (credit), guarantees of payment of customs debt, guarantees of lease payments, counter-guarantees, etc.

In practice, a special type of guarantee is distinguished, a super guarantee. It is provided in favor of the beneficiary who wants to receive, in addition to the guarantee of the debtor’s bank, an additional guarantee from a more famous and reliable bank on the same conditions. In this case, the guarantor assumes the obligation to compensate the other bank for the funds that the latter will have to pay according to the super guarantor.

A syndicated guarantee is also possible in case of high risks or significant contract value.

The leading bank issues a guarantee for the full amount, and this guarantee is secured by counter guarantees of the participants in the syndicate. In the event of a guarantee payment, the leading bank collects funds from the banks participating in the syndicate on a recourse basis.

The economic role of bank guarantees in large business projects

The essence of bank guarantees is that the issuing bank minimizes the risk of fulfillment of obligations by the principal.

The beneficiary gets an additional opportunity to pay off his receivables under the main contract. Formally, the issuing bank neither assumes the principal’s debt, nor becomes responsible for this debt.

The economic role of the guarantee, which actually serves as collateral for the debt, distinguishes BG from standard payment instruments such as a bank letter of credit. In its modern form, bank guarantees have many economic advantages that explain the rapid development of this type of service in the financial sector.

The issuer of the guarantee undertakes to pay for the goods or services when the guarantee event has occurred and the company has not paid the supplier (contractor).

Thus, payments for BG are made in the following cases:

• The occurrence of a guarantee event, which means that the main commercial contract has not been fulfilled.

• The impossibility of eliminating the consequences of the guarantee event at the expense of the principal.

The beneficiary cannot use the bank guarantee only in other situations, except for the two listed cases.

Satisfaction of the financial interests of the beneficiary by the principal without submitting documents to the bank does not give the right to use the guarantee. This condition lays the foundations for mutually beneficial relationships within the BG.

Before issuing a guarantee, the bank assesses the risk of a guarantee event.

This requires a careful analysis of the beneficiary, which may be insufficiently reliable or abuse BG mechanism, requesting compensation in cases that are known to be inappropriate to the terms of the contract.

From the point of view of the bank, the reliability of BG and letters of credit comes down to a high-quality check of compliance with the formal requirements related to the payment request (the applicant submits the required documents). It is not surprising that, in world practice, letters of credit sometimes served as bank guarantees.

Table: Some features of the use of bank guarantees in large projects.

| Features | Brief description |

| Complexity of operations | BGs are considered to be technically complex financial instruments, which is explained by increased security requirements and the need for numerous checks, control and monitoring. |

| Assessment and control | The reliability of this financial instrument is related to the quality of client verification and assessment of the risk of a guarantee event. |

| Confidence in partners | Issuance of BG increases the confidence of business partners in the client, since the bank carefully analyzes the financial position of the company and concludes about its reliability. |

| Increased liquidity | Companies that use this financial instrument should not freeze large funds in the bank (as, for example, when securing letters of credit). |

| Project monitoring | The control by the bank does not end after the issuance of the guarantee, since the financial risks in each case must be assessed throughout the life of the project. |

| High costs | A deep assessment of the client and the transaction, the need for constant monitoring, along with high risks, makes a bank guarantee an expensive financial instrument |

| Lack of uniform standards | BG is a diverse and heterogeneous financial instrument that can be used in various forms and can be modified for a specific industry or even a contract. |

| Development of priority sectors | The use of bank guarantees makes it possible to actively develop priority sectors, such as the construction of residential real estate. |

| Damage coverage | The funds paid by the guarantor usually significantly exceed the damage, which makes this instrument attractive for high-risk areas. |

The security function of a bank guarantee is to stimulate the principal to properly fulfill its contractual obligations to the beneficiary company under the main contract.

This feature, which plays an important role in large projects, is based on three factors:

• Legitimation. The issuance of BG indicates the ability of the principal to fully fulfill the contractual obligations. The bank can provide a guarantee only after successful analysis of the company and risk assessment.

• Compensation. Breach of the main contract by the principal in most cases results in the loss of significant funds and / or reputational losses. BG partially or fully compensates for the potential losses of the counterparty.

• Motivation. This function is based on the threat of loss of business reputation and funds by the principal as a result of non-fulfillment or improper fulfillment of contractual obligations to the beneficiary.

As a sophisticated and highly adaptable financial instrument, a bank guarantee can be customized to protect specific phases of a contract.

This approach is very convenient for large multi-stage projects that are associated with numerous risks and uncertainties.

After the fulfillment of the obligation, the principal is exempted in this part from the fulfillment of the main contractual obligation. However, he has an obligation to pay certain funds to the guarantor.

Growing need for bank guarantees

Against the background of the growth in the number of large international projects, the need arose for a reliable legal instrument that would help to compensate for damage caused by the failure of the parties to fulfill their obligations under the contract.

Banks will not waste time and energy on potential debt repayment disputes with clients. Financial institutions strive to create a clear legal environment and eliminate unnecessary litigation.

BG helps banks to do their job by selling money profitably and receiving compensation from the principal without delay.

This financial instrument perfectly achieves its goals, and therefore has found application in various fields.

These include large tenders, contract enforcement, customs relations, and more. However, only strong companies that own liquid assets can become the subjects of the guarantee obligation. This financial instrument is used by companies that seek to increase the confidence of potential partners in their business. BG is often required to obtain a large loan for capital-intensive projects.

On the other hand, a guarantee may be required by a contractor who is concerned about the risk of insolvency of their partners. Having a bank guarantee, it is much easier for a company to convince a potential lender of the advisability of cooperation.

Guarantees are considered primarily by small businesses or companies that are dependent on a large contract. For these companies, the insolvency of the contractor would be a serious problem, which leads to bankruptcy.

Bank guarantees are also used by large companies that implement expensive and risky projects that require significant funds.

Having a bank guarantee from a reputable financial institution, it is much easier for the participants of such a project to obtain long-term financing on favorable terms.

However, a bank guarantee will require transparency and high financial stability of the applicant. Banks put forward a long list of conditions that a company must fulfill before using this financial instrument.

It may be necessary, for example, to open a bank account with a specific bank and provide additional material security (real estate, equipment or other assets). A positive credit rating and strict adherence to the conditions set by the guarantor usually allows for the conclusion of the contract.

The cost of the bank guarantee services is usually determined on an individual basis, based on the assessment of the financial health of the client.

Most often, the cost is based on a certain percentage of the guarantee amount plus fixed fees.

Tender guarantees and their application

According to the Uniform Rules for Contractual Guarantees, tender guarantees refer to an undertaking that is issued by an insurer, bank or other institution at the request of a tenderer (principal) or other authorized party (instructing party) to the party issuing a tender (beneficiary).

As part of the obligation, the guarantor is obliged to compensate the beneficiary for potential losses in case of non-fulfillment of contractual obligations by the principal.

The tender guarantee is intended to protect the interests of the company that organized the tender, to compensate for losses in the event that the tenderer refuses to cooperate during the validity period of his tender proposal. It also applies to cases of winning by a tender participant and his subsequent refusal to conclude a contract.

The amount of the bank guarantee for large projects in this case varies from 1 to 5%, sometimes exceeding this limit, depending on the specific project.

The term of the guarantee for the fulfillment of contractual obligations can be about six months or more.