Financing mining projects

Service

DANEROCK Investment Group offers:

• Investment financing from €50 million and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Loan guarantees

Sector

✓ Project finance and investment consulting from DANEROCK Investment Group:

• From €50 million and more.

• Investments up to 90% of the project cost.

• Loan term from 10 to 20 years.

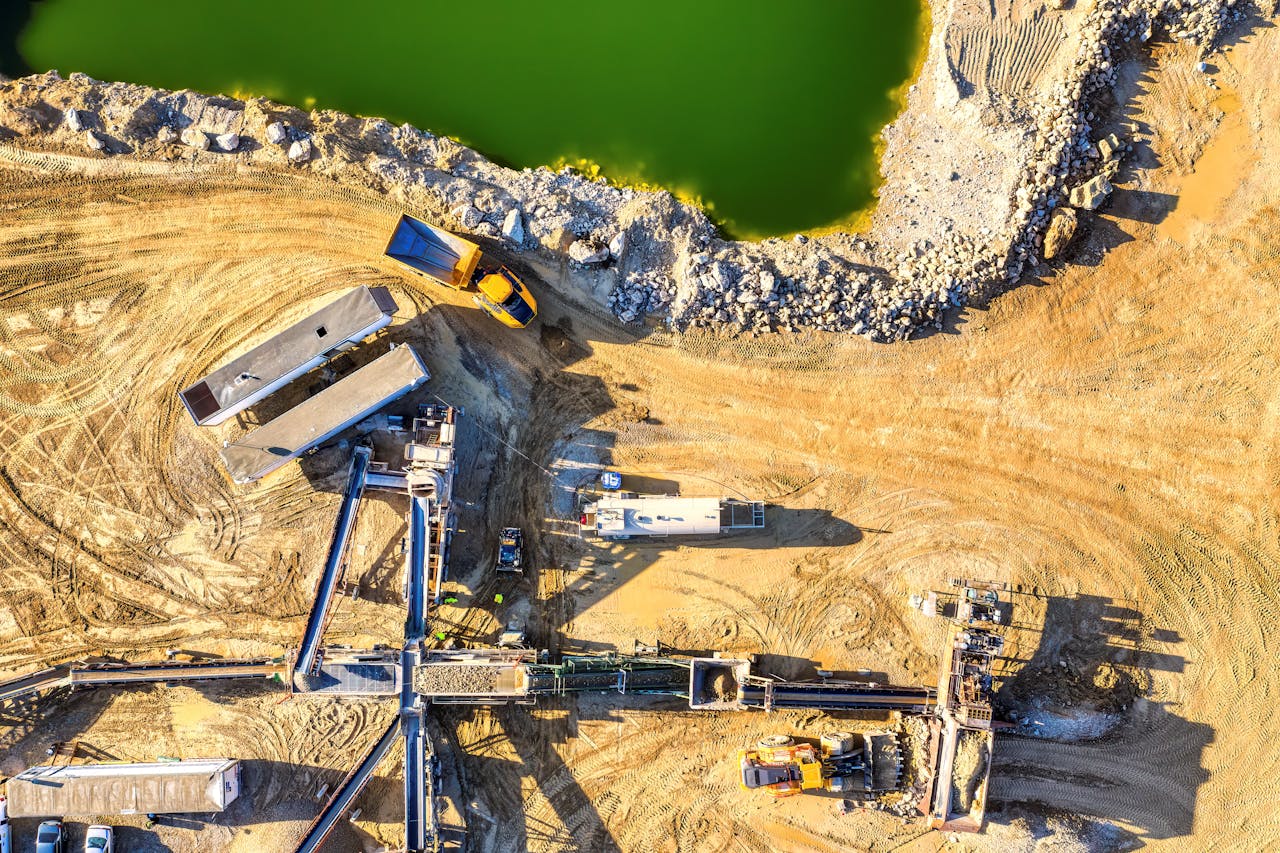

Mining and processing of minerals throughout the history of mankind has remained the foundation of economic growth and technical progress.

Currently, the assets of the largest mining companies in the world exceed 1.1 trillion dollars, and their total operating expenses reach half a trillion dollars.

Not surprisingly, the financing of mining projects attracts the attention of numerous investment experts and businessmen.

This capital-intensive industry needs billions of dollars of investment every day to function effectively.

ESFC Investment Group, a Spanish company with an international presence, has brought together experienced professionals who are ready to provide the best financing schemes for large projects in the field of mining and processing of minerals.

Basics of financing mining projects

Most mining companies in previous years felt the negative effects of the economic downturn, since key markets and commodity prices remained unstable.

For this reason, companies have significantly reduced their expenses, refusing geological exploration and postponing expansion plans.

Despite the recent jump in prices for minerals due to the geopolitical situation, the prospects for the global economy remain uncertain, and the market is weak. A great importance for the future of this industry will have the right choice of a source of financing of mining projects.

Any mining project consists of such stages as geological exploration and prospecting for mineral deposits, development of a deposit, operation and closure. Each of these stages requires significant financial resources, especially exploration. Moreover, initiators cannot guarantee investors adequate returns at an early stage, which means a certain level of risk.

At an early stage, it is critically important to choose the right structure and instruments for project financing.

In this sense, the forecast of profit that can be obtained from the exploitation of the field is decisive, since it will determine the financial needs of the project and the financing structure.

Main sources of financing

Attracting the necessary financial resources for the implementation of a mining project requires the active use of various sources, including loans, issuance of bonds, leasing, etc.

Possible sources of funding for mining and processing plants include the following:

• International Finance Corporation and other specialized development agencies.

• Free capital market (issue of bonds and other securities).

• Banks and other lending institutions.

• Insurance companies and pension funds.

• Private investment funds.

• Buyers of minerals, etc.

Below we have listed possible alternative financing options for mining and processing plants, noting some of their features, advantages and disadvantages:

• Capital: equity financing. This category plays a relatively minor role in the sector, as capital-intensive mining projects usually require significant borrowing in the early stages.

• Debt: debt financing. This type of financing opens up unlimited opportunities for companies to use the so-called financial leverage. This includes corporate lending based on the company’s balance sheet and solvency. In recent years, project finance has played an important role, which involves long-term project financing with limited recourse (debt repayment is guaranteed by project assets and future cash flows).

• Stream financing of mining projects. This particular type of financing consists of the obligation of the mining company to sell resources in exchange for an upfront payment. This instrument entitles the buyer to purchase all or part of the minerals produced by the mine.

• Off-taker financing. The buyer of minerals can be a valuable source of additional financing. Commercial companies or end users often seek to provide their business with raw materials for the future, so they are willing to take on the financing of mining projects. Off-takers are ready to make capital investments or provide a loan on favorable terms. However, the most common form of this type of financing is a combination of an advance payment for future deliveries and a discount to the market price under an off-take contract.

• Bridge funding. This refers to the provision of available funds for a short period, which is used by the owner of a mining project to get out of a difficult financial situation until long-term financing is obtained.

• Joint venture, royalties, guarantees and other financing mechanisms.

If you are looking for the best way to finance a mining project, ESFC Investment Group is ready to offer your company with a long-term loan.

We also provide comprehensive financial services for large businesses, including guarantees, financial modeling, investment engineering and consulting.

Making a decision on financing mining project

Each mining project is unique in its essence, goals and structure. For this reason, it is impossible to specify a single correct approach to making a funding decision.

The funding decision may be based on the following factors:

• Investment risk: financial, political, social, environmental and other types of risk.

• Estimated cost of developing the project and schedule of financing.

• Financing model chosen taking into account various external and internal factors.

• Assets, resources and technologies owned by project participants.

• Type of mining company: size, capital, specialization, market and other parameters.

• Expected profit of the future exploitation of the field.

Funding decisions are made solely by project owners or sponsors. In some cases of corporate finance, there is no sponsor, but in project finance this figure is always required.

The decision should be based on a cost-benefit analysis, taking into account the objectives of the participants.

Since obtaining loans for mining projects is quite difficult for new players, some young mining companies in emerging markets prefer to seek funding from investors in the stock market. This approach really allows the business to shift some of the risks associated with launching or continuing a project onto investors.

However, the truth is that the financial system is unable to take on this risk at a low cost of financing.

In developing countries, few market participants offer young companies to receive venture capital funding for their mineral exploration activities (although this depends on the situation and the specific type of minerals).

The use of different financial instruments in the mining industry

Debt financing of mining projects is carried out by concluding a loan or credit agreement.

The loan can be bilateral or syndicated (when several financial institutions join forces to minimize risks). The latter is the case when it comes to large mining projects or significant resources are required.

A syndicated loan is the most complex, as consortium develops a multifaceted contractual structure and bind themselves to the same terms. The problem may lie in the shares of financing, the distribution of risks and profits. From the point of view of each lender, the main goal is to ensure that the principal loan with interest is repaid on time. This can be quite difficult to guarantee, especially when the borrower continues exploration work and cannot prove the feasibility of building a facility in a particular region.

For this reason, commercial banks prefer to join the financing of mining projects at a later stage.

The financial institution will only provide financing if it is truly confident that the project will generate sufficient cash flow to pay off the principal with interest. In addition, the bank team carefully analyzes the financial health of a borrower and determines whether he has a financial “airbag” in case of unforeseen circumstances.

Aspects important for lenders and investors

What will enable lenders to decide on a loan to finance a mining project?

First, the documentary basis (forecast), according to which the project will allow the borrower to generate sufficient cash flows.

Secondly, professional independent project control is always an advantage.

Finally, any lender seeks to obtain collateral or loan guarantees.

Table. The main aspects in the organization of project finance schemes for a mining project.

| Criteria | Brief description |

| High quality business plan and technical documentation | The feasibility study and other studies must be carried out to a high standard to maximize the chance of achieving the project objectives and to ensure that the debt is repaid on time. The mining plan should include a project estimate and schedule, detailed project specifications, capital costs, expected mining levels and costs. With regard to the financial model, it is necessary to comprehensively analyze the economics of the project. |

| Establishment of a special purpose vehicle (SPV) | The investment project must be owned by an SPV with an adequate capital structure that does not own assets other than the project assets and associated assets. The type of company may vary (JSC, LLC). |

| Due diligence | Due diligence concerns the brand, the reputation of the sponsors and the management team. The lenders will conduct a full DD before allocating funds. In this regard, the company will need the assistance of a legal and financial team specialized in these matters. Investors and lenders must be satisfied with the reputation of the project sponsor and have a high level of trust in the team that manages it. |

| The financial contribution of the initiators | The lenders do not provide the mining companies with 100% of the funding needs and hence a contribution is required from the project sponsors or owners. This is usually required to be done before the first tranche is made available. The sponsor or owner of the project, as the case may be, will be required to provide additional money to fund unexpected construction costs or penalties for construction delays. |

| Guarantees | Debt repayment guarantee can be provided in different forms, depending on the legislation of the country and the particular sector. Loans can be secured by high-liquidity assets, assignment of contracts (for example, foreign investment contracts, PPAs, leasing agreements), transfer of company shares, and other means. |

| Legal regulation | Sponsors or project owners should take into account local legal requirements that apply to financial documents (for example, a loan agreement). Guarantee agreements are governed by the law of the country where the relevant assets are located. |

| Insurance coverage | Insurance significantly increases the interest of creditors to participate in high-risk mining projects. This is especially important in the early stages when exploration work has not been completed. |

Aspects important for borrowers or project initiators

Mining companies whose projects require external financing strive to attract resources on the most favorable terms and in the most efficient way in terms of time and cost of borrowed capital.

The limited experience of small companies requires the involvement of reputable financial advisors who will help build the optimal contract structure and obtain financing. The further fate of the project will largely depend on the borrower’s company, the time frame of the project, the market situation and the right choice of partners.

It is also highly recommended that the project proponent be supported by a professional legal team that has gained experience in the financing of mining projects and related industries.

This will save time and money as these professionals have a good understanding of the negotiation process and the requirements of creditors and can identify potential bottlenecks in the process.

Alternative financing options for mining projects

The focus of this section is an overview of alternative financing mechanisms for projects in the mining industry.

These instruments can be used in combination with traditional corporate finance schemes or partially replace them in long-term capital-intensive projects.

Streaming finance for mining industry

The streaming agreement on mineral resources is an agreement for the sale of minerals, through which a buyer (streaming company) makes an upfront payment in favor of a mining company.

The upfront payment is made in exchange for the right to receive in the future the amount of ore agreed upon by the parties. Regarding the payment methods, there can be aforementioned upfront payment, as well as fixed payments in installments or additional increments of the upfront payment.

In the streaming agreement, the buyer acquires rights on the future production of the mining facility, and not rights on a percentage of its income (as is the case with the so-called royalty agreement).

Characteristic features of this type of agreement include the following:

• The mineral is paid in advance and at a preferential price.

• Streaming agreement always means a long-term agreement (3-5 years or more).

• The paid ore has not yet been produced, which introduces an element of risk.

Thus, the streaming agreement allows the seller, who is the owner or shareholder of the project, to finance the development of the mining project before the start of operation and generation of cash flows. On the other hand, this method of financing allows the buyer, who pays in advance, to secure a future supply of the required minerals, usually at a better price than the market selling price.

Streaming agreements are usually long-term agreements, as they are designed to provide the necessary funding before the commercial operation of the mine begins.

The sale of the ore must continue for a sufficient period of time to enable the debtor to repay the debt.

Financing mining projects under this scheme is not suitable for all types of minerals.

Firstly, a specific mineral must necessarily be mined within a specific mining project in sufficient quantities.

Secondly, the reserves must reach a certain level. In principle, streaming agreements allow project owners to supply minerals from any of the company’s mines, as long as the mineral resources meets quantity and quality requirements established by the agreement.

Financing mining using royalty agreements

The royalty agreement has a long tradition in the mining industry, especially in Anglo-Saxon countries, where it is considered standard throughout the industry.

This type of agreement includes the project owner (royalty payer) receiving from a third party an advance payment. The owner of the mining project obliged to pay part of the income of the project to the third party (beneficiary).

Royalty agreements are not regulated by law in all countries of the world, so its content largely depend on the parties. There are several examples of such agreements in the Anglo-Saxon legal system, so the terms are generally standard and well known to the contracting parties.

The royalties are used to obtain funding against a future obligation to pay a percentage of the profits from the mine’s production. This contract, unlike the streaming agreement, entitles the beneficiary to receive part of the cash flows generated by the project owner as a result of the sale of minerals that are mined in the specified area. The royalty beneficiary assumes part of the market risks. However, the beneficiary may be a company with little or no experience in the mining market, because it receives payments without being directly involved in the sale of ore.

The following mechanisms have traditionally been used to calculate royalty payments:

• Net Smelter Return (NSR) refers to the way in which royalties are calculated from income received from the sale of minerals produced by a mining project, less the costs of processing and extracting minerals, transportation, insurance, and interest.

• Net Profits Interest (NPI) refers to royalties that give the beneficiary a share of the net profit received from the sale of minerals.

Royalties are usually paid out over a long period of time, usually until the end of the life of the project. Payments may be set for a specific project or deposit, such that any mineral mined in a specified area requires the owner of the mine to pay royalties in accordance with the agreement.

Private investment funds

These are investment funds with private capital, national or foreign, formed for the purpose of investing their capital in certain industries or projects (for example, mines, quarries or mining and processing plants).

These are specialized funds led by industry experts who are looking for specific projects / investment opportunities where they can achieve the maximum economic effect.

The advantages of such funds are high specialization in the industry, combined with investment flexibility and limited terms for attracting investments (usually private investment funds invest in projects for a period of 5-10 years). This is a very convenient tool for alternative financing of mining projects when loans are unavailable or undesirable for certain reasons.

Private equity funds work with contributions from individuals who invest personal capital for the sole purpose of maximizing returns. Fund management is limited to the industries in which it can professionally and efficiently invest contributors’ money (eg renewable energy, agriculture, heavy industry, mining). Since these funds operate in specific investment areas, their management usually consists of experts who make better investment decisions with more information and knowledge.

Private placements and Earn-in agreements

Private placements refer to financing mining projects through the purchase of shares of the companies developing the project. In this case, the person who provide the financing is not a creditor, but becomes a partner of the company that develops the project.

This mechanism is similar to traditional project financing, but certain alternatives have appeared.

For example, placements through the Stand-by Equity Distribution Agreement (SEDA) as a type of share allocation agreement between a mining company and a share purchaser.

There are also Earn-in agreements, referred to private placements, in which the capital provider commits to purchase shares in the owner of the mining project, paying for them over a specified period of time. In this type of contract, a clear investment schedule is set, where the provider of capital pays for shares, thus providing money to the company against the completion of certain critical milestones or progress in the project.

DANEROCK Investment Group has been providing professional services in the field of investment project financing, investment engineering / consulting for a long time.

We cooperate with large companies around the world, including Spain, the United States, the UK, Germany, Saudi Arabia, Vietnam, Brazil, Mexico, Chile, and more.

Contact us to find out more.